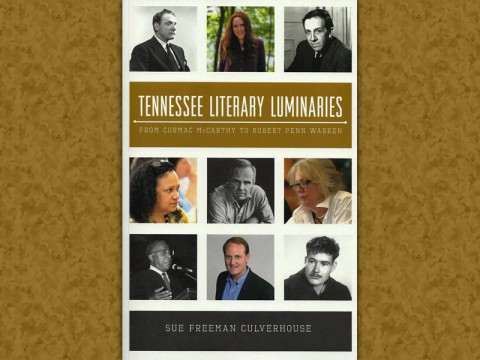

Learn about Tennessee Authors in Sue Freeman Culverhouse’s “Tennessee Literary Luminaries”

January 13, 2014

Clarksville, TN – Sue Freeman Culverhouse, long a staff-writer for ClarksvilleOnline.com, features eleven Tennessee authors in her new book. Tennessee Literary Luminaries: From Cormac McCarthy to Robert Penn Warren (The History Press, Charleston, SC, 2013). Her author website, www.sueculverhouse.com, links her readers to information about the book and her upcoming blog.

Clarksville, TN – Sue Freeman Culverhouse, long a staff-writer for ClarksvilleOnline.com, features eleven Tennessee authors in her new book. Tennessee Literary Luminaries: From Cormac McCarthy to Robert Penn Warren (The History Press, Charleston, SC, 2013). Her author website, www.sueculverhouse.com, links her readers to information about the book and her upcoming blog.

“I’m tired of people outside Tennessee believing that we’re all wearing overalls without a shirt, chewing tobacco, going barefoot, toting six-shooters, and living off road kill,” Culverhouse admits. “I want our youngsters to be proud of the literary heritage these and other Tennessee writers have contributed to the world of literature. All of the authors in my book have interesting lives in addition to having written not-to-be missed books.”

Fed to taper; Congress passes a Budget

December 20, 2013

Clarksville, TN – Federal Reserve policymakers decided to trim something other than trees at their December meeting.

Clarksville, TN – Federal Reserve policymakers decided to trim something other than trees at their December meeting.

The central bank made the long-awaited decision to begin reducing its monthly pace of asset purchases from $85 billion to $75 billion, starting in January 2014. This is the first step towards unwinding the economic stimulus.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of October 8th, 2013

October 8, 2013

Clarksville, TN – Due to a lapse in appropriations, the government entered a partial shutdown. Some 800,000 federal workers were furloughed and about two million others continued to work but without getting paid. The economic impact of the shutdown will depend on how long it lasts.

Clarksville, TN – Due to a lapse in appropriations, the government entered a partial shutdown. Some 800,000 federal workers were furloughed and about two million others continued to work but without getting paid. The economic impact of the shutdown will depend on how long it lasts.

A few days would not be a big deal, but a prolonged shutdown would result in a larger disruption of worker income (and corresponding restraint in consumer spending). In addition, the uncertainty may lead businesses to delay new hiring or capital expenditures. During the 1995-96 government shutdown, about 20% of private contracts with the government were affected.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of September 29th, 2013

September 29, 2013

Clarksville, TN – Next week, the markets will be interested in the ISM Manufacturing Index, but the focus should be on the September Employment Report. Seasonal adjustment is an issue in September.

Clarksville, TN – Next week, the markets will be interested in the ISM Manufacturing Index, but the focus should be on the September Employment Report. Seasonal adjustment is an issue in September.

We can expect to add more than 1.4 million education jobs (public and private) before adjustment, with hundreds of thousands of seasonal job losses in other areas. So it seems a little silly to worry about the nearest 20,000 or so in the adjusted payroll figure. The unemployment rate is expected to hold steady (at 7.3%) or edge a bit lower

Clarksville Weekly Market Snapshot from Frazier Allen for the week of September 22nd, 2013

September 22, 2013

Clarksville, TN – The Federal Open Market Committee did not reduce the pace of asset purchases. In its policy statement, the FOMC noted that the improvement in economy activity and labor market conditions since it began the asset purchase program a year ago was “consistent with growing underlying strength in the broader economy,” but “the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases.”

Clarksville, TN – The Federal Open Market Committee did not reduce the pace of asset purchases. In its policy statement, the FOMC noted that the improvement in economy activity and labor market conditions since it began the asset purchase program a year ago was “consistent with growing underlying strength in the broader economy,” but “the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases.”

Clarksville Weekly Market Snapshot from Frazier Allen for the week of September 15th, 2013

September 15, 2013

Clarksville, TN – With a thin economic calendar, Syria remained a key concern for the markets. However, prospects for a U.S. strike diminished, which helped bolster equity market sentiment. The bond market is looking ahead to the Fed policy meeting. In the bond market, expectations on tapering have solidified somewhat, with a moderate majority seeing a small initial reduction in the pace of asset purchases.

Clarksville, TN – With a thin economic calendar, Syria remained a key concern for the markets. However, prospects for a U.S. strike diminished, which helped bolster equity market sentiment. The bond market is looking ahead to the Fed policy meeting. In the bond market, expectations on tapering have solidified somewhat, with a moderate majority seeing a small initial reduction in the pace of asset purchases.

Retail sales for August disappointed (relative to expectations), but figures for June and July were revised a bit higher. Jobless claims were distorted due to upgrades in state computer systems, but the trend had been lower in August. Hiring intentions improved. Consumer sentiment softened.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of September 8th, 2013

September 8, 2013

Clarksville, TN – The economic data were mixed, but mostly on the strong side of expectations. The ISM’s two monthly surveys surprised to the upside. Motor vehicle sales advanced

Clarksville, TN – The economic data were mixed, but mostly on the strong side of expectations. The ISM’s two monthly surveys surprised to the upside. Motor vehicle sales advanced

However, the August Employment Report disappointed. Nonfarm payrolls rose by 169,000 (vs. a median forecast of +180,000 and expectations of an upside surprise). Figures for June and July were revised a net 74,000 lower (July went from +162,000 to +104,000).

Manufacturing rose by 6,000. Construction was flat. Retail added 44,000. The unemployment rate fell to 7.3%, but that was due to lower labor force participation (the lowest since May 1978).

Investors looking for answers from the Fed, Government

September 4, 2013

Clarksville, TN – August saw all three of the major U.S. stock market indexes fall into negative territory, as investors become more concerned about the possibility of rising rates and potential military action in Syria.

Clarksville, TN – August saw all three of the major U.S. stock market indexes fall into negative territory, as investors become more concerned about the possibility of rising rates and potential military action in Syria.

Emerging markets, particularly Brazil and India, also took a hit in August as their economies weakened and their currencies fell against the dollar.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of September 1st, 2013

September 1, 2013

Clarksville, TN – The economic data were consistent with a slowing in the rate of overall growth in July.

Clarksville, TN – The economic data were consistent with a slowing in the rate of overall growth in July.

The estimate of second quarter growth was revised higher (to a 2.5% annual rate, vs. +1.7% in the advance estimate), but that was almost entirely due to a smaller-than-expected trade deficit (the estimate of consumer spending growth was the same and the estimate of business fixed investment was only slightly different).

Personal income and spending figures showed a poor start for the consumer in 3Q13. Durable goods orders tanked in July, reflecting a drop in aircraft orders (which were strong in May and June). However, ex-transportation orders still disappointed.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of August 4th, 2013

August 4, 2013

Clarksville, TN – The Federal Open Market Committee left short-term interest rates unchanged, as expected, and did not alter its forward guidance (on short-term interest rates) or the monthly pace of asset purchases.

Clarksville, TN – The Federal Open Market Committee left short-term interest rates unchanged, as expected, and did not alter its forward guidance (on short-term interest rates) or the monthly pace of asset purchases.

In the policy statement, the FOMC noted that growth had been “modest” in the first half of the year, that mortgage rates had risen “somewhat,” and that a persistent low trend in inflation could present some risks for the economy. All of which suggests that a tapering in the rate of asset purchases will be delayed. However, investors should still expect some tapering by the end of the year. [Read more]