Clarksville Weekly Market Snapshot from Frazier Allen for the week of March 6th, 2016

March 6, 2016

Clarksville, TN – Nonfarm payrolls rose more than expected in February, while figures for the two previous months were revised higher. At 228,000, the three-month average has remained strong. The unemployment rate held steady at 4.9%, but labor force participation continued to pick up and the employment/population ratio is trending higher.

Clarksville, TN – Nonfarm payrolls rose more than expected in February, while figures for the two previous months were revised higher. At 228,000, the three-month average has remained strong. The unemployment rate held steady at 4.9%, but labor force participation continued to pick up and the employment/population ratio is trending higher.

Hours fell, likely reflecting bad weather (weakness in hours was concentrated in mining, which includes energy exploration, and construction). Average hourly earnings fell 0.1% (following a 0.5% rise in January), bringing the year-over-year gain down to 2.2% (from 2.5%), but the three-month average was up nearly 2.5% y/y.

University of Memphis professor Dr. Beverly Bond to discuss 1866 Memphis Massacre at APSU on March 31st

March 6, 2016

Clarksville, TN – The bitter fighting which defined the Civil War ended on April 9th, 1865 when Confederate Gen. Robert E. Lee surrendered the last major Confederate army at Appomattox Courthouse.

Clarksville, TN – The bitter fighting which defined the Civil War ended on April 9th, 1865 when Confederate Gen. Robert E. Lee surrendered the last major Confederate army at Appomattox Courthouse.

But the laying down of arms and the realization of a Union victory did little to quell the fires of hatred in the newly reunited and “reconstructed” United States of America.

Clarksville Civil War Roundtable’s next meeting is February 17th, 2016

February 11, 2016

The 143rd Meeting.

Clarksville, TN – The next meeting of the Clarksville (TN) Civil War Roundtable will be on Wednesday, February 17th, 2016 at the Bone & Joint Center, 980 Professional Park Drive, right across the street from Gateway Medical Center. This is just off Dunlop Lane and Holiday Drive and only a few minutes east of Governor’s Square mall.

Clarksville, TN – The next meeting of the Clarksville (TN) Civil War Roundtable will be on Wednesday, February 17th, 2016 at the Bone & Joint Center, 980 Professional Park Drive, right across the street from Gateway Medical Center. This is just off Dunlop Lane and Holiday Drive and only a few minutes east of Governor’s Square mall.

The meeting begins at 7:00pm and is always open to the public. Members please bring a friend or two – new recruits are always welcomed.

Topic: “General William Bate of Tennessee”

Clarksville Weekly Market Snapshot from Frazier Allen for the week of February 7th, 2016

February 7, 2016

Clarksville, TN – The economic data were mixed. The ISM Manufacturing Index remained below the break even level in January, with a pickup in new orders and a softening in employment.

Clarksville, TN – The economic data were mixed. The ISM Manufacturing Index remained below the break even level in January, with a pickup in new orders and a softening in employment.

The ISM’s Non-Manufacturing Index slowed more than anticipated. The January Employment Report seemed to have something for everybody. Nonfarm payrolls rose less than forecast.

However, the unemployment rate edged lower, hours moved higher and average hourly earnings advanced – all likely to catch the attention of Fed policymakers.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of January 27th, 2016

January 27, 2016

Clarksville, TN – Global worries continued, but the U.S. stock market rebounded somewhat after a sharp slide on Wednesday, lending hope to the view that the worst is behind us. Oil prices also improved, but it’s not clear whether the global outlook was helped by higher oil prices or the other way around.

Clarksville, TN – Global worries continued, but the U.S. stock market rebounded somewhat after a sharp slide on Wednesday, lending hope to the view that the worst is behind us. Oil prices also improved, but it’s not clear whether the global outlook was helped by higher oil prices or the other way around.

Yields on long-term Treasuries fell on the flight to safety, but that was partly unwound as global worries eased at the end of the week. Investors also took encouragement from European Central Bank President Draghi’s comments that the ECB will review and reconsider its policy outlook in March.

Clarksville Civil War Roundtable’s next meeting is January 20th, 2016

January 18, 2016

The 142th Meeting

Clarksville, TN – The next meeting of the Clarksville (TN) Civil War Roundtable will be on Wednesday, January 20th, 2016 at the Bone & Joint Center, 980 Professional Park Drive, right across the street from Gateway Medical Center. This is just off Dunlop Lane and Holiday Drive and only a few minutes east of Governor’s Square mall.

Clarksville, TN – The next meeting of the Clarksville (TN) Civil War Roundtable will be on Wednesday, January 20th, 2016 at the Bone & Joint Center, 980 Professional Park Drive, right across the street from Gateway Medical Center. This is just off Dunlop Lane and Holiday Drive and only a few minutes east of Governor’s Square mall.

The meeting begins at 7:00pm and is always open to the public. Members please bring a friend or two – new recruits are always welcomed.

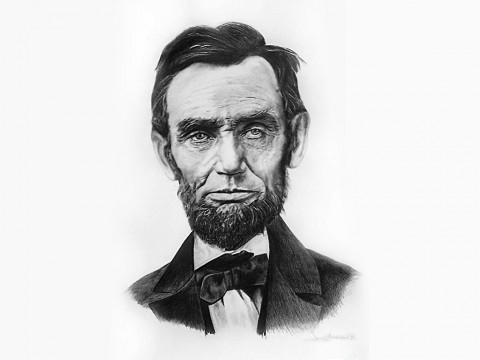

Topic: “Abraham Lincoln and the Russians”

Clarksville Weekly Market Snapshot from Frazier Allen for the week of January 16th, 2016

January 17, 2016

Clarksville, TN – The important economic data reports were bunched up on Friday. December retail sales results were somewhat disappointing. Industrial production was weighed down by mild temperatures (lower output of utilities) and a further contraction in energy exploration.

Clarksville, TN – The important economic data reports were bunched up on Friday. December retail sales results were somewhat disappointing. Industrial production was weighed down by mild temperatures (lower output of utilities) and a further contraction in energy exploration.

Manufacturing output edged down modestly, mixed across sectors, but generally soft over the last several months. The New York Fed’s Empire State Manufacturing Index fell sharply in January.

Southeast Tourism Society Selects the Rivers and Spires Festival as a ‘Top 20 Event’

December 18, 2015

Travel industry organization has saluted region’s best events since 1985

Clarksville, TN – The Southeast Tourism Society has named Clarksville’s Rivers & Spires Festival one of the STS Top 20 Event in the Southeast for April 2016.

Clarksville, TN – The Southeast Tourism Society has named Clarksville’s Rivers & Spires Festival one of the STS Top 20 Event in the Southeast for April 2016.

This year’s Rivers and Spires Festival is scheduled for April 14th-16th, 2016. The STS Top 20 Festival and Event Awards have highlighted programs around the Southeast since 1985.

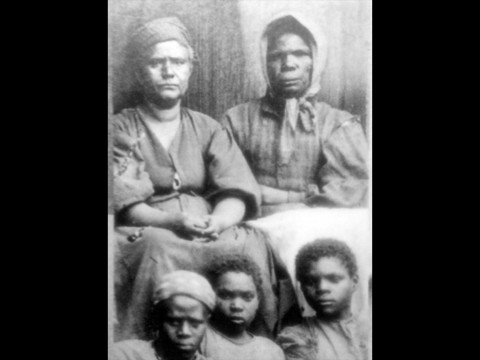

The Freed Slaves of Montgomery County

December 14, 2015

Clarksville, TN – Every human being has worth and deserves dignity. “Everyone matters” is an incredibly powerful humanitarian ideal, and one upon which the United States seems to continually both build and define. We hear the whispers of this ideal within the words of the Declaration of Independence.

Clarksville, TN – Every human being has worth and deserves dignity. “Everyone matters” is an incredibly powerful humanitarian ideal, and one upon which the United States seems to continually both build and define. We hear the whispers of this ideal within the words of the Declaration of Independence.

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.

The generation of Americans which fought to free us from the tyranny of Europe in the late 18th Century probably could not have grasped how these words, and the spirit of the ideal they reflect would be used by subsequent generations to form the nation we live within today.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of December 13th, 2015

December 13, 2015

Clarksville, TN – The economic calendar was thin. The headline retail sales figures for November were not far from expectations, but core sales (which exclude autos, building materials and gasoline) were up 0.6% (stronger than anticipated). The Producer Price Index continued to reflect disinflation pressure, with falling prices within the pipeline.

Clarksville, TN – The economic calendar was thin. The headline retail sales figures for November were not far from expectations, but core sales (which exclude autos, building materials and gasoline) were up 0.6% (stronger than anticipated). The Producer Price Index continued to reflect disinflation pressure, with falling prices within the pipeline.

Commodity prices fell further, led by a drop in oil (now below the critical $40.00 level). Anxieties about the decline in commodity prices fed through to the stock market, which fell broadly during the week and cast some doubt about the Fed’s ability to raise rates next week (still likely, but increased financial instability could lead to a delay).