F&M Bank announces Frazier Allen achieves Membership in Raymond James Financial Services 2018 Executive Council

January 17, 2018

Clarksville, TN – Frazier Allen, Financial Advisor located at F&M Bank, 50 Franklin Street Clarksville, TN was recently named a member of the 2018 Executive Council.*

Clarksville, TN – Frazier Allen, Financial Advisor located at F&M Bank, 50 Franklin Street Clarksville, TN was recently named a member of the 2018 Executive Council.*

Allen, who joined Raymond James in 2005, has more than 18 years of experience in the financial services industry. Allen combines his experience with quality investment alternatives and the latest information and technology available.

Frazier Allen: Tune in to levels of control

June 3, 2017

Clarksville, TN – Know what you can tweak to find your ultimate retirement income mix.

Clarksville, TN – Know what you can tweak to find your ultimate retirement income mix.

As much as some of us would like to control everything, the truth is we can’t. Many retirees harbor a distant fear that their money may not last as long as they need it to.

When it comes to something as important as your retirement income, knowing what you can control and by how much may help save your energy for the things you can change.

Frazier Allen: Eight Estate Documents Everyone Needs

August 25, 2016

Clarksville, TN – Estate planning helps take the decision-making stress off you and your family. Having documents in place will allow you to define life’s big decisions, including how you would like your medical care and finances managed. Family members and healthcare providers will be clear of what you want if you are unable to speak for yourself.

Clarksville, TN – Estate planning helps take the decision-making stress off you and your family. Having documents in place will allow you to define life’s big decisions, including how you would like your medical care and finances managed. Family members and healthcare providers will be clear of what you want if you are unable to speak for yourself.

We can help you navigate the process and coordinate with an estate planning attorney to make sure your updated documents align with your financial plan.

Frazier Allen: Equity markets stumble in August on global worries

September 2, 2015

Clarksville, TN – The equity markets, and subsequently investors, experienced some wild swings toward the end of August, spurred in part by China’s faltering economy and a drop in oil prices. On paper, global equities have lost trillions in value after China unexpectedly devalued its currency earlier this month.

Clarksville, TN – The equity markets, and subsequently investors, experienced some wild swings toward the end of August, spurred in part by China’s faltering economy and a drop in oil prices. On paper, global equities have lost trillions in value after China unexpectedly devalued its currency earlier this month.

The move triggered concern that one of the world’s largest economies, especially its manufacturing sector, is growing at a slower rate. Consumer confidence also declined in August as the stock market turbulence dulled Americans’ outlook for the economy.

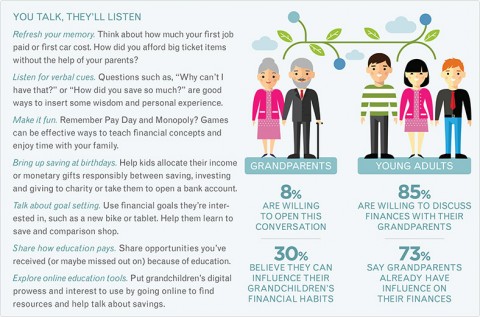

Frazier Allen talks about Connecting Two Generations

August 23, 2015

Boomers and millennials have similar attitudes about money

Clarksville, TN – Grandparents, get ready to share your money memories. Maybe it’s the commonalities of post-Depression and post-recession saving mentalities. Or maybe being a generation away soothes the pressures of parental advice and control. Whatever the reason, millennials crave financial guidance from their grandparents.

Clarksville, TN – Grandparents, get ready to share your money memories. Maybe it’s the commonalities of post-Depression and post-recession saving mentalities. Or maybe being a generation away soothes the pressures of parental advice and control. Whatever the reason, millennials crave financial guidance from their grandparents.

Millennials saw the recession firsthand. They have high levels of student debt, continue to receive parental financial support into and beyond their college years, and more than half are living paycheck-to-paycheck. With that comes a slight chance to create long-term savings.

Equity markets slide after an eventful month

August 1, 2014

Clarksville, TN – The last week of July has been eventful on a number of fronts. The economic calendar was packed, geopolitical tensions intensified and Argentina teetered on the edge of default, eventually going over. This is the second time the South American country has defaulted on its debt in the past 13 years.

Clarksville, TN – The last week of July has been eventful on a number of fronts. The economic calendar was packed, geopolitical tensions intensified and Argentina teetered on the edge of default, eventually going over. This is the second time the South American country has defaulted on its debt in the past 13 years.

The default may be short-lived if Argentina can reach an agreement to pay its missed $1.5 billion interest payment.

Stocks up despite U.S. Government Budget Impasse

October 2, 2013

Clarksville, TN – The third quarter of the year proved quite eventful.

Clarksville, TN – The third quarter of the year proved quite eventful.

The Federal Reserve opted to wait a little longer before beginning to dial back its bond purchases, and a budgetary showdown in D.C. resulted in a partial government shutdown on the same day the private healthcare exchanges mandated by the 2010 Affordable Care Act (ACA) opened.

Political tensions arose over whether to defund or delay major provisions of the ACA.

Markets gain ground, await further Fed guidance

August 3, 2013

Clarksville, TN – July was certainly eventful in terms of market movements and economic news. Stocks were up for the month, with the S&P 500 posting its biggest monthly gain since January, making up for its decline in June.

Clarksville, TN – July was certainly eventful in terms of market movements and economic news. Stocks were up for the month, with the S&P 500 posting its biggest monthly gain since January, making up for its decline in June.

All the major indices ended July in higher territory after housing prices posted their largest gain in seven years and the Commerce Department reported that advanced estimates show that gross domestic product grew more than forecast in the second quarter. [Read more]

Market Update from Frazier Allen, June 23rd, 2013

June 23, 2013

Clarksville, TN – Equities across the globe fell sharply after Federal Reserve Chairman Ben Bernanke implied that the central bank may start to wind down its asset purchases later this year if the economy continues to improve. The three major domestic indices took a hit, and the CBOE Volatility Index spiked to a new high this year.

Clarksville, TN – Equities across the globe fell sharply after Federal Reserve Chairman Ben Bernanke implied that the central bank may start to wind down its asset purchases later this year if the economy continues to improve. The three major domestic indices took a hit, and the CBOE Volatility Index spiked to a new high this year.

The statement triggered a selloff on Wednesday and Thursday, as markets reacted to the prospect of higher interest rates. Many market observers already had forecast when this third round of quantitative easing would dial down, but the markets responded regardless. [Read more]

Weekly Market Snapshot from Frazier Allen for the week of March 17th, 2013

March 17, 2013

Market Commentary by Scott J. Brown, Ph.D., Chief Economist

The economic data were mixed, but the stock market continued to focus on the good news and ignored the rest. Retail sales rose more than expected in February, but results varied across sectors. Industrial production picked up, following a weak January (results varied by industry).

The inflation reports showed some pressure from higher gasoline, as anticipated, and moderate core inflation. Treasury reported a smaller deficit than a year ago. Initial claims for unemployment benefits continued to trend lower. Consumer sentiment fell in the mid-March assessment, with a sharp decline in expectations (down to a 15-month low).

The Dow Jones Industrials Average continued to new record highs, up 10 sessions in a row. In contrast to the optimism expressed in equities, bond yields have remained relatively low.

Next week, housing figures have some market-moving potential, but February is not a “make or break” month for the sector (weather can have an impact). The March figures will be more important. No surprises are expected from the Fed policy meeting on Wednesday.

Officials have had a public debate about the potential costs and benefits of current policy and the settled view is that the benefits (to the labor market, in particular) outweigh the potential that we may see excessive risk-taking and financial instability. The Fed will release revised projections of growth, unemployment, and inflation. Note that the Fed policy announcements will now be made at 2:00pm. On the last meeting of the quarter, the Fed will also release revised projects at 2:00 p.m. and Bernanke’s press briefings will follow at 2:30pm.

Indices

| Last | Last Week | YTD return % | |

| DJIA | 14539.14 | 14329.49 | 10.95% |

| NASDAQ | 3258.93 | 3232.09 | 7.93% |

| S&P 500 | 1563.23 | 1544.26 | 9.61% |

| MSCI EAFE | 1699.43 | 1682.67 | 5.95% |

| Russell 2000 | 953.07 | 934.57 | 12.21% |

Consumer Money Rates

| Last | 1-year ago | |

| Prime Rate | 3.25 | 3.25 |

| Fed Funds | 0.17 | 0.15 |

| 30-year mortgage | 3.51 | 3.92 |

Currencies

| Last | 1-year ago | |

| Dollars per British Pound | 1.509 | 1.567 |

| Dollars per Euro | 1.301 | 1.302 |

| Japanese Yen per Dollar | 95.880 | 83.630 |

| Canadian Dollars per Dollar | 1.023/td> | 0.993 |

| Mexican Peso per Dollar | 12.465 | 12.700 |

Commodities

| Last | 1-year ago | |

| Crude Oil | 93.03 | 105.43 |

| Gold | 1592.90 | 1636.25 |

Bond Rates

| Last | 1-month ago | |

| 2-year treasury | 0.26 | 0.27 |

| 10-year treasury | 2.00 | 2.03 |

| 10-year municipal (TEY) | 3.31 | 3.07 |

Treasury Yield Curve – 03/15/2013

S&P Sector Performance (YTD) – 03/15/2013

Economic Calendar

| March 18th |

— |

Homebuilder Sentiment (March) |

| March 19th |

— |

Building Permits, Housing Starts (February) |

| March 20th |

— |

FOMC Policy Decision, Bernanke Press Briefing |

| March 21st |

— |

Jobless Claims (week ending March 16th) Philadelphia Fed Index (March) Existing Home Sales (February) Leading Economic Indicators (February) |

| March 26th |

— |

Durable Goods Orders (February) New Home Sales (February) Consumer Confidence (March) |

| March 29th |

— |

Good Friday Holiday (markets closed) Personal Income and Spending (February) |

| April 5th |

— |

Employment Report (March) |

| April 10th |

— |

FOMC Minutes (March 20th) |

Important Disclosures

US government bonds and treasury bills are guaranteed by the US government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. US government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the US government.

Commodities trading is generally considered speculative because of the significant potential for investment loss. Markets for commodities are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Specific sector investing can be subject to different and greater risks than more diversified investments.

Tax Equiv Muni yields (TEY) assume a 35% tax rate on triple-A rated, tax-exempt insured revenue bonds.

![]() Material prepared by Raymond James for use by its financial advisors.

Material prepared by Raymond James for use by its financial advisors.

The information contained herein has been obtained from sources considered reliable, but we do not guarantee that the foregoing material is accurate or complete. Data source: Bloomberg, as of close of business February 28th, 2013.

©2013 Raymond James Financial Services, Inc. member FINRA / SIPC.