Frazier Allen: Where Your Retirement Money Goes

August 19, 2016

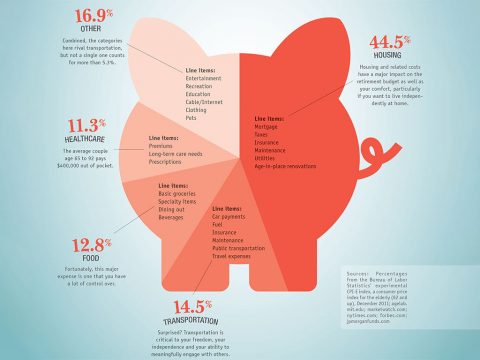

Clarksville, TN – As you consider a long, happy retirement, give some thought to the largest aspects of your budget.

Clarksville, TN – As you consider a long, happy retirement, give some thought to the largest aspects of your budget.

Where your money actually goes may surprise you.

Wealth alone cannot buy a quality retirement any more than it can buy happiness – but having a solid financial foundation can make those years more enjoyable.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of August 14th, 2016

August 14, 2016

Clarksville, TN – The economic data remained consistent with moderate economic growth and low inflation. Retail sales figures for July disappointed, coming in below expectations (but partly offset by upward revisions to June).

Clarksville, TN – The economic data remained consistent with moderate economic growth and low inflation. Retail sales figures for July disappointed, coming in below expectations (but partly offset by upward revisions to June).

Preliminary productivity figures for the second quarter were weak (averaging a 0.5% annual rate over the last five years). Jobless claims remained very low. The Producer Price Index fell more than expected and pipeline pressures remained mild or slightly deflationary.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of August 7th, 2016

August 7, 2016

Clarksville, TN – As expected, the Federal Open Market Committee left short-term interest rates unchanged. In its policy statement, the FOMC noted that “on balance, payrolls and other labor market indicators point to some increase in labor utilization in recent months.”

Clarksville, TN – As expected, the Federal Open Market Committee left short-term interest rates unchanged. In its policy statement, the FOMC noted that “on balance, payrolls and other labor market indicators point to some increase in labor utilization in recent months.”

More importantly, “near-term risks to the economic outlook have diminished.” Kansas City Fed President Esther George dissented in favor of raising the federal funds target range by 25 basis points (to 0.50% to 0.75%).

Frazier Allen: Charitable Perks and Generosity to Spare

July 31, 2016

Clarksville, TN – It’s a fact: People love to get something for free, whether they need it or not. Often those freebies pile up or sit unused.

Clarksville, TN – It’s a fact: People love to get something for free, whether they need it or not. Often those freebies pile up or sit unused.

For example, nearly 75% of airline miles go unredeemed every year, according to Consumer Reports, and a third of credit card rewards points gather digital dust, representing $16 billion in value, a 2011 study by Colloquy shows. What if you could turn those free perks into a charitable gift instead?

Here are several ways to turn your excess into meaningful extras for your favorite charities.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of July 24th, 2016

July 24, 2016

Clarksville, TN – The economic data calendar was thin and reports were of little consequence for the markets. As expected, the European Central Bank left short-term interest rates unchanged and did not alter its asset purchase plans.

Clarksville, TN – The economic data calendar was thin and reports were of little consequence for the markets. As expected, the European Central Bank left short-term interest rates unchanged and did not alter its asset purchase plans.

ECB President Draghi indicated that policymakers were encouraged by the financial stability following the initial reaction to the Brexit vote. He also said that more information will become available over time and the ECB would act using all possible tools “if needed.”

Clarksville Weekly Market Snapshot from Frazier Allen for the week of July 19th, 2016

July 19, 2016

Clarksville, TN – The economic data were generally on the strong side of expectations. Retail sales rose 0.6% in June (median forecast: +0.2%), but figures for April and May were revised down (still a strong quarter).

Clarksville, TN – The economic data were generally on the strong side of expectations. Retail sales rose 0.6% in June (median forecast: +0.2%), but figures for April and May were revised down (still a strong quarter).

Industrial production rose 0.6%, but that largely reflected a rebound in auto output (which had fallen in May). Ex-autos, manufacturing output was flat (-0.2% y/y, consistent with a soft patch, not a recession).

Frazier Allen: 20 Financial Things Couples Should Know

July 13, 2016

Clarksville, TN – More than 40% of couples recently unveiled that they don’t know how much their partner earns. And 1 in 10 couldn’t guess within a $25,000 margin of error.

Clarksville, TN – More than 40% of couples recently unveiled that they don’t know how much their partner earns. And 1 in 10 couldn’t guess within a $25,000 margin of error.

These couples, who share their lives together, have no idea what their total household income is. Yet, the majority of those same couples claim they regularly have open conversations about their finances. There’s a disconnect somewhere.

The Couples Retirement Study by Fidelity Investments revealed that many couples could stand to dive a little deeper when it comes to their joint financial lives.

Having a solid understanding of your financial status is crucial to planning, budgeting and saving toward your goals.

Frazier Allen: Your Retirement Plan B

July 12, 2016

Clarksville, TN – Imagine this. You’ve spent decades working, saving and planning for your version of the ideal retirement.

Clarksville, TN – Imagine this. You’ve spent decades working, saving and planning for your version of the ideal retirement.

But life decides to throw a little kink into your plans. Your company was just acquired, and your boss is now strongly encouraging you to take an early retirement – five years before you’re ready.

Take the time to design an alternative retirement plan should retirement come earlier than expected.

Clarksville Weekly Market Snapshot from Frazier Allen for the week of July 10th, 2016

July 10, 2016

Clarksville, TN – The economic data were mostly on the strong side of expectations. Nonfarm payrolls surprised sharply to the upside in June (+287,000), but that followed a very soft payroll figure for May (revised to +11,000).

Clarksville, TN – The economic data were mostly on the strong side of expectations. Nonfarm payrolls surprised sharply to the upside in June (+287,000), but that followed a very soft payroll figure for May (revised to +11,000).

The disappointing May number is now seen as an anomaly, but then so was the June figure. Large month-to-month swings in payrolls are unusual, but they do happen occasionally.

The three-month average payroll gain was +147,000, slower than in 1Q16 (+196,000) and 2015 (+221,000).

Clarksville Weekly Market Snapshot from Frazier Allen for the week of July 6th, 2016

July 6, 2016

Clarksville, TN – Despite there being no plan for Brexit and expectations of a lengthy and uncertain process of disentanglement from the European Union, stock market fear subsided.

Clarksville, TN – Despite there being no plan for Brexit and expectations of a lengthy and uncertain process of disentanglement from the European Union, stock market fear subsided.

The impact on the U.S. economy of a weaker U.K. is expected to be small, and in some ways may even be positive (lower mortgage rates and greater capital flows to the U.S.). Long-term interest rates remain low.

Bank of England Governor Carney helped things along by suggesting that a rate cut would likely be warranted this summer (the BoE’s Monetary Policy Committee will meet on July 14th).