Frazier Allen: Can Debt be used to your advantage?

August 29, 2016

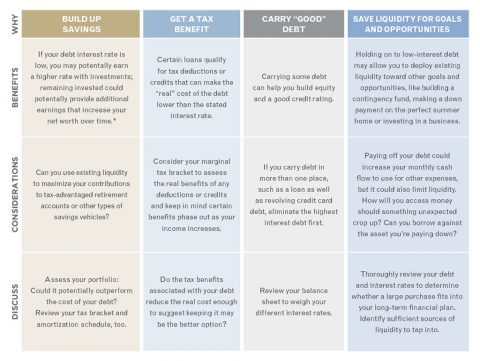

Clarksville, TN – “Debt” tends to call to mind a negative connotation. But, when used strategically, certain kinds can serve as useful financial tools, affording you access to more liquidity and potential growth down the road.

Clarksville, TN – “Debt” tends to call to mind a negative connotation. But, when used strategically, certain kinds can serve as useful financial tools, affording you access to more liquidity and potential growth down the road.

Before setting out to pay your debt off as quickly as possible, consider the various factors at play. You may find that the long-term advantages of holding certain types of debt can outweigh the benefits of paying it off sooner, so be sure to discuss the benefits and considerations with a knowledgeable financial professional.

Frazier Allen: Eight Estate Documents Everyone Needs

August 25, 2016

Clarksville, TN – Estate planning helps take the decision-making stress off you and your family. Having documents in place will allow you to define life’s big decisions, including how you would like your medical care and finances managed. Family members and healthcare providers will be clear of what you want if you are unable to speak for yourself.

Clarksville, TN – Estate planning helps take the decision-making stress off you and your family. Having documents in place will allow you to define life’s big decisions, including how you would like your medical care and finances managed. Family members and healthcare providers will be clear of what you want if you are unable to speak for yourself.

We can help you navigate the process and coordinate with an estate planning attorney to make sure your updated documents align with your financial plan.

Frazier Allen: Are your estate and financial plans shock-proof?

August 23, 2016

Clarksville, TN – Retirement is a time to enjoy family, hobbies, travel, volunteering, and maybe even taking a job that sounds fun and keeps you active. You may be in great health today and can’t imagine a time when you wouldn’t be able to do all the things you’ve dreamed about.

Clarksville, TN – Retirement is a time to enjoy family, hobbies, travel, volunteering, and maybe even taking a job that sounds fun and keeps you active. You may be in great health today and can’t imagine a time when you wouldn’t be able to do all the things you’ve dreamed about.

While we all hope to live independently throughout retirement and plan to take care of ourselves, it’s still wise to put contingency plans into place, to shock-proof our financial and estate plans just in case.

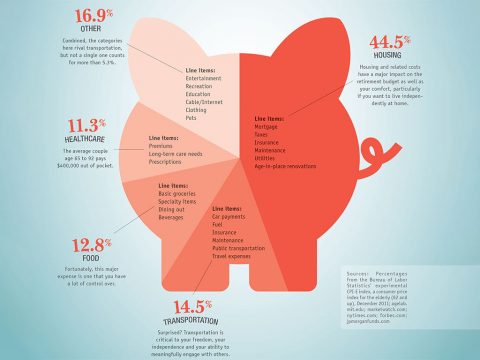

Frazier Allen: Where Your Retirement Money Goes

August 19, 2016

Clarksville, TN – As you consider a long, happy retirement, give some thought to the largest aspects of your budget.

Clarksville, TN – As you consider a long, happy retirement, give some thought to the largest aspects of your budget.

Where your money actually goes may surprise you.

Wealth alone cannot buy a quality retirement any more than it can buy happiness – but having a solid financial foundation can make those years more enjoyable.

Frazier Allen: 20 Financial Things Couples Should Know

July 13, 2016

Clarksville, TN – More than 40% of couples recently unveiled that they don’t know how much their partner earns. And 1 in 10 couldn’t guess within a $25,000 margin of error.

Clarksville, TN – More than 40% of couples recently unveiled that they don’t know how much their partner earns. And 1 in 10 couldn’t guess within a $25,000 margin of error.

These couples, who share their lives together, have no idea what their total household income is. Yet, the majority of those same couples claim they regularly have open conversations about their finances. There’s a disconnect somewhere.

The Couples Retirement Study by Fidelity Investments revealed that many couples could stand to dive a little deeper when it comes to their joint financial lives.

Having a solid understanding of your financial status is crucial to planning, budgeting and saving toward your goals.

Frazier Allen: Your Retirement Plan B

July 12, 2016

Clarksville, TN – Imagine this. You’ve spent decades working, saving and planning for your version of the ideal retirement.

Clarksville, TN – Imagine this. You’ve spent decades working, saving and planning for your version of the ideal retirement.

But life decides to throw a little kink into your plans. Your company was just acquired, and your boss is now strongly encouraging you to take an early retirement – five years before you’re ready.

Take the time to design an alternative retirement plan should retirement come earlier than expected.

Frazier Allen: July 2016 Investment Strategy Quarterly Recap

July 9, 2016

Clarksville, TN – Financial market headwinds for the next six to twelve months include political uncertainty in the U.S., a strengthening U.S. dollar, significant uncertainty surrounding Britain’s recent referendum on leaving the European Union (“Brexit”), and earnings growth.

Clarksville, TN – Financial market headwinds for the next six to twelve months include political uncertainty in the U.S., a strengthening U.S. dollar, significant uncertainty surrounding Britain’s recent referendum on leaving the European Union (“Brexit”), and earnings growth.

Tailwinds include low oil prices, an improving labor market, and a low interest-rate environment.

Frazier Allen: The Sharing Economy Matures

June 15, 2016

Clarksville, TN – The sharing economy – made up of peer-to-peer, access-driven businesses – is growing up quickly.

Clarksville, TN – The sharing economy – made up of peer-to-peer, access-driven businesses – is growing up quickly.

Just seven years ago, Airbnb began an online platform connecting people with extra space with travelers looking for a room; now it’s a juggernaut recently valued at $25 billion with an average of 425,000 guests per night, 22% more than Hilton Worldwide.

Frazier Allen: Ten Financial Tips for First Time Job Seekers

June 14, 2016

Clarksville, TN – Timing is everything when it comes to taking the right steps toward a secure financial future. For recent grads new to the workforce, it’s not always clear what those first steps should be. Most college graduates enter the real world as financial planning rookies. This can be daunting, as your 20s are an important time to lay a foundation for financial stability.

Clarksville, TN – Timing is everything when it comes to taking the right steps toward a secure financial future. For recent grads new to the workforce, it’s not always clear what those first steps should be. Most college graduates enter the real world as financial planning rookies. This can be daunting, as your 20s are an important time to lay a foundation for financial stability.

Making smart decisions at this age can have a powerful positive impact on your fiscal future. As the next generation enters the working world, here are 10 tips to get them started on a bright financial future.

New grads entering the workplace can pave the way toward a secure financial future with these simple steps.

Frazier Allen: Creating the Financial Plan for Those with Dementia

June 13, 2016

Clarksville, TN – These five topics cover distinct financial-management issues and caregiving plans. Ideally, you will have these conversations with your loved one and that person’s financial advisor in the mild decline stage of Alzheimer’s, or even before the diagnosis.

Clarksville, TN – These five topics cover distinct financial-management issues and caregiving plans. Ideally, you will have these conversations with your loved one and that person’s financial advisor in the mild decline stage of Alzheimer’s, or even before the diagnosis.

If the disease has progressed beyond this period, you—or the designated power of attorney—may need to have these discussions solely with the advisor. It is important for you and the advisor to understand the source and destination of your loved one’s finances so you can help when the individual may no longer be able to communicate his or her wishes.