Frazier Allen: Do Risk and Retirement Mix?

November 29, 2017

Clarksville, TN – Adding more stocks to your income plan may help offset low interest rates and inflation.

Clarksville, TN – Adding more stocks to your income plan may help offset low interest rates and inflation.

We live in unusual times, with interest rates at historical lows but likely to rise in the not-too-distant future, stocks trading at what some consider elevated levels driven by a years-long bull market, and investors scouring the pronouncements of central banks for clues to what may happen next.

However, one thing remains unchanged – those in or near retirement still have to map out a prudent strategy for generating income in the years ahead.

Frazier Allen: Help your money last with these 7 tips to generate a retirement paycheck

November 26, 2017

Clarksville, TN – With retirement within sight, now’s the time to figure out how to turn your savings and investments into a paycheck – so you can live comfortably and still achieve your goals.

Clarksville, TN – With retirement within sight, now’s the time to figure out how to turn your savings and investments into a paycheck – so you can live comfortably and still achieve your goals.

For many, the challenge is easier said than done, and comes alongside fears of spending too much now and not having enough later or the worry of denying yourself if you don’t spend enough.

Here are seven ways to help you get and stay on the right track.

Frazier Allen: Debunking Social Security myths

September 5, 2017

Clarksville, TN – It’s time to shine some light on common Social Security misconceptions to help you get the most from your hard-earned benefits.

Clarksville, TN – It’s time to shine some light on common Social Security misconceptions to help you get the most from your hard-earned benefits.

Myth #1 – Social Security won’t be around

FACT – Social Security is replenished by working Americans, interest on its bonds and taxes on some retiree benefits. Should the existing surplus be depleted, future retirees may be paid a portion of the benefits promised, but not zero.

Frazier Allen: Smart Retirement Withdrawal Strategies

June 4, 2017

Clarksville, TN – For many, tapping into your retirement principal causes some anxiety.

Clarksville, TN – For many, tapping into your retirement principal causes some anxiety.

Whether you’re months or years from retirement, work with your advisor to develop a withdrawal strategy that gives you confidence that your money will last as long as your retirement does.

Fortunately, there are flexible strategies that can be used alone or in combination. With each of these strategies, it’s a good idea to start with a conservative withdrawal rate and increase it as your portfolio grows.

Frazier Allen: Tune in to levels of control

June 3, 2017

Clarksville, TN – Know what you can tweak to find your ultimate retirement income mix.

Clarksville, TN – Know what you can tweak to find your ultimate retirement income mix.

As much as some of us would like to control everything, the truth is we can’t. Many retirees harbor a distant fear that their money may not last as long as they need it to.

When it comes to something as important as your retirement income, knowing what you can control and by how much may help save your energy for the things you can change.

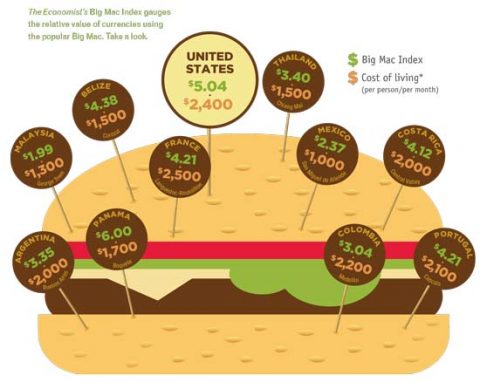

Frazier Allen: Retirement choices go Global

June 1, 2017

Clarksville, TN – If the prospect of a pleasant retirement in an exotic locale appeals to you, you’re in luck because the options for retiring abroad are expanding. The numbers of expat English-speaking communities are growing in countries that offer safety, low taxes, attractive residency options and excellent healthcare facilities.

Clarksville, TN – If the prospect of a pleasant retirement in an exotic locale appeals to you, you’re in luck because the options for retiring abroad are expanding. The numbers of expat English-speaking communities are growing in countries that offer safety, low taxes, attractive residency options and excellent healthcare facilities.

Life in a foreign land is not for everyone, of course. There is almost certain to be an element of culture shock. However, the attractions of an adventurous lifestyle tip the scales for many retirees. Retirement experts caution against making hasty decisions to move abroad.

Frazier Allen: Where Medicare Falls Short

May 14, 2017

Clarksville, TN – It’s never too early to start thinking and planning for retirement, especially when it comes to the top three expenses: housing, transportation and healthcare. You may have a clear vision of your ideal retirement, but that dream could fade if unexpected healthcare costs start to eat away at your hard-earned retirement savings.

Clarksville, TN – It’s never too early to start thinking and planning for retirement, especially when it comes to the top three expenses: housing, transportation and healthcare. You may have a clear vision of your ideal retirement, but that dream could fade if unexpected healthcare costs start to eat away at your hard-earned retirement savings.

The fact is, even with Medicare, quality healthcare can come with a hefty price tag. There are still premiums, copayments, deductibles and other out-of-pocket expenses that must be accounted for.

Clarksville Police warns public about criminals posing as salesmen that take advantage of senior citizens.

Frazier Allen: Retirement Readiness Takes Getting in Step

April 17, 2017

Clarksville, TN – When Fidelity Investments asked couples how much they think they will need to save for retirement to maintain their current lifestyle, 48% had “no idea.”

Clarksville, TN – When Fidelity Investments asked couples how much they think they will need to save for retirement to maintain their current lifestyle, 48% had “no idea.”

Forty-seven percent disagreed on the amount needed (the disagreement highest among those closest to retirement). In some ways, that’s not surprising – many couples disagree on financial and lifestyle matters long before they’ve stopped working. But while adjustments (hopefully) can be made and differences resolved, things can become more difficult in retirement.

Frazier Allen: A Retirement Savings Exit Strategy

December 16, 2016

Clarksville, TN – Every day, an estimated 10,000 people reach the IRS trigger age when they must begin withdrawing money from their retirement plans. If you’re among them, it’s wise to develop a strategy.

Clarksville, TN – Every day, an estimated 10,000 people reach the IRS trigger age when they must begin withdrawing money from their retirement plans. If you’re among them, it’s wise to develop a strategy.

Once you hit 70½, IRS rules call for required minimum distributions (RMDs) every year on all of your traditional, simplified employee pension (SEP) and SIMPLE IRAs, as well as employer-sponsored plans. Roth IRAs are exempt.

Create a plan to withdraw your minimum distributions on your terms, while complying with Uncle Sam’s.

Frazier Allen: Learning to be a Retiree

November 27, 2016

Clarksville, TN – Most of us really look forward to the idea of well-deserved, unstructured free time. A time to do exactly what we please when we please. Until we get it.

Clarksville, TN – Most of us really look forward to the idea of well-deserved, unstructured free time. A time to do exactly what we please when we please. Until we get it.

A retirement satisfaction survey from EBRI found that half of retirees (51.4%) in 2012 reported being somewhat or not at all satisfied with their retirement. Some retirees underestimate how long it takes to adjust to a new lifestyle; others miss friends from work; still others find themselves with too much free time.